What is the role of China today? While some on the left have celebrated China’s ambitions as a counterweight to the United States, Jorge Martín explains that capitalism has long been restored in China, and today it has all the features of a rising imperialist power. ‘Multipolarity’ will not benefit the workers of the world, who must trust solely in their own strength to throw off the chains of imperialism and capitalism internationally.

The following is a transcript of a talk given by Jorge Martín last year at Revolution Festival, the annual school of communism organised by the British section of the International Marxist Tendency.

First of all, let's clear something up. In the media in the West, and amongst the leading politicians of western imperialism in Britain, in the United States, and so on, there is a constant, anti-Chinese campaign. They say "China is bad", "China's doing all these bad things", (which they are obviously also doing themselves, but nevermind that) "China's very bad", "China is scheming and manipulating", it is apparently paying some some people in Westminster to influence politicians, as if this never happens in this country, and stuff like that.

Now, this is not an anti-China talk. But this is a communist attempt to understand what China is and what role China plays in world relations.

We are internationalists, and we do not support our own ruling class. We do not defend the rights of our own imperialist ruling class. We want to analyse the situation from the point of view of the interests of the working class, the working class in China, and the working class around the world. It is important for communists to understand world relations and where this comes from.

The starting point is this: China is a capitalist country and has been so for some time.

I'm trying to use Chinese official figures. I wouldn't say that some of these figures need to be taken with a pinch of salt, but they need to be understood, because sometimes the definitions of what is a privately owned company or mixed company or state company is a bit complicated and doesn't necessarily correspond to what we would normally understand. But according to Chinese official figures, the private sector, defined restrictively as firms with less than 10 percent state participation in the first half of 2023, was about 40 percent of GDP. This is one figure that you can look at. But this was the lowest that this figure has been since 2019.

During the pandemic, the private sector decreased a little bit, and the state sector has correspondingly increased. The private sector reached a peak of 55 percent of GDP around 2021. But I think that it is not just the weight of the private sector, but also, it's important to look at where the arrow is pointing. What is the direction of the process? In 2010, the private sector defined in this way was only 8 percent of the GDP, and is now around 50 percent.

According to official figures, over 80 percent of the industrial workforce, i.e. workers who work specifically in industry, are in the private sector. The private sector contributes 50 percent of exports, and exports are obviously an important part of the Chinese economy, more so than in some other capitalist countries.

In 2011, i.e. when this process was still at the beginning, or had started maybe 10 years earlier or so, Shen Danyang, spokesman for the Chinese Ministry of Commerce said, that “after 30 years of reform and opening up, China has completed the transformation from a planned economy to a market economy”. This was the official position of the Chinese state back in 2010. You also have to take this with a slight pinch of salt, because at that time they were in negotiations about joining the WTO, and that involved a dispute over whether the Chinese economy should be considered a planned economy or not. But that gives you an idea of what the situation is.

China is a capitalist country in which the state plays a big role in the economy / Image: Dong Fang

China is a capitalist country in which the state plays a big role in the economy / Image: Dong Fang

I will say that for some years now, it cannot be contested that the Chinese state defends and promotes capitalist property relations. Yes, China is a capitalist country in which the state plays a big role in the economy. This is because of its history and other factors that come from having transitioned from a planned economy to a capitalist economy. But nevertheless, the state sector is used in order to defend, promote and foster capitalist property relations.

What dominates in China is not economic planning, but rather the private profit motive. And this is how the capitalist economy works in China after a process that took over 30 years.

Another interesting factor is Chinese capital abroad, i.e. Chinese capitalists from other countries played a big role in the development of capitalism in China. They were the first ones to invest in private companies, bringing plants into China and so on. But obviously international capital also played a big role. And this was a big part of what in the 1990s was called a process of globalisation which included the integration of China into the capitalist market.

There was massive investment by western companies in China, which they originally used as a source of cheap labour. This is what they were looking for. They were looking for cheap labour in order to be able to produce cheaply. And as an aside, this played a big role for the whole period of time in keeping inflation down in the advanced capitalist countries. This was an important part of the political and economic situation in the 1990s and beyond.

A legitimate question that can be asked is: how is it possible that a backward, dominated country, like China was before the Chinese revolution in 1949, has become a powerful part of the world economy, a powerful developed capitalist economy?

If you read Trotsky's theory of permanent revolution, it says that the national bourgeois in dominated countries and in backward capitalist countries in the epoch of imperialism cannot play a progressive role, and cannot carry out the tasks of the bourgeois revolution, the national democratic revolution.

But China is different, because in China it was not the capitalist class, the Chinese bourgeois, which carried out those tasks. It was the Chinese Revolution that abolished capitalism, and went a long way in solving the national democratic tasks in China, which are mainly agrarian reform with the expropriation of landlordism, and the question of national unification and national sovereignty.

China in 1990 or in 2000, was no longer a backward country dominated by imperialism, it was an independent country, where many of the tasks of the national democratic revolution had been solved decades earlier. And this was the basis on which capitalist development started in China. On top of this, there were other elements: the fact that there was a strong state, there was universal education, a high level of education and cultural level, which allowed China to catch up with a number of advanced technologies, and so on.

China also has not only become a capitalist country, it has become a capitalist country that has changed its character in the international division of labour. It was originally, as I said, a country dominated by cheap labour and the export of cheap commodities; toys, textiles, cheap electronic goods, and so on. But it is now no longer that, or those features of the capitalist economy that China had maybe 20 years ago, are no longer dominant in China.

I would argue, right now, China has moved towards a higher technology and higher wages economy. The average monthly wage in urban areas in China today is about US$1,300, according to CEIC figures. That figure, although it disguises a lot of regional disparities and disparities between sectors, would make Chinese workers' wages higher than wages, for instance, in Albania, in Romania, in Mexico and in other countries where capitalists go looking for cheap labour.

And that has a number of consequences. There are now some companies (for different reasons, but one of which is wages) that are moving away from China or away from the coastal areas, that are more economically developed, into cheaper labour areas, or into other cheaper labour economies in Asia, or into other cheaper labour economies that are closer to the capitalist markets that these companies want to want to serve (like Mexico). This is a process which has been labelled “near-shoring” or “friend-shoring”.

The Chinese economy has adopted very advanced technologies. In some sectors, Chinese technology is ahead of other capitalist imperialist countries. Just to give one example: electric vehicles, which is a growing sector of the capitalist economy. I'm not an engineer by any stretch of imagination, but what I understand is that the most important thing in an electric vehicle is not so much the engine, but the battery, the battery and the range that this battery might have and so on.

Now, there is a Chinese company called CATL. This is the largest maker of electric vehicle batteries in the world and controls 34 percent of the world's market for electric vehicle batteries, and it's well ahead of any other company and supplies all the major car manufacturers in the world, including Tesla, Ford, Volvo (which is obviously no longer a Swedish multinational, it has now been bought or bought off by Chinese capital).

And how has China achieved that? Well, by the traditional methods of a capitalist country: by stealing technology, by sending thousands of students to study in the most prestigious universities in Britain, in the United States, investing a lot of money in research and development campuses, and basically by investing in a series of sectors that they think are sectors that are the future of capitalist economy, and therefore gaining an advantage over other countries.

This is also part of combined and uneven development. A formerly backward economy can jump ahead in certain sectors. China, for instance, has an advantage in that they never had a massive traditional combustion engine car manufacturing industry as the West has, and therefore the transition to electric vehicles is much faster, and this can be replicated in many other sectors of the economy.

China is playing an imperialist role in the world economy and in world relations / Image: Kent Wang, Flickr

China is playing an imperialist role in the world economy and in world relations / Image: Kent Wang, Flickr

China's role in the world has also changed. And I will argue that China is playing an imperialist role in the world economy and in world relations.

Now what does imperialism mean? When we talk about imperialism from a communist point of view, we don't mean a general, common sense understanding of imperialism, as in an aggressive foreign policy, military invasions and so on. That is part of imperialism.

But if you look at Lenin's definition of imperialism, the classic features that Lenin describes in his book, "Imperialism, the highest stage of capitalism", are:

“1) the concentration of production and capital developed to such a high stage that it created monopolies which play a decisive role in economic life; (2) the merging of banking capital with industrial capital, and the creation, on the basis of this “finance capital,” of a financial oligarchy; (3) the export of capital as distinguished from the export of commodities acquires exceptional importance; (4) the formation of international monopolist capitalist associations which share the world among themselves, and (5) the territorial division of the whole world among the biggest capitalist powers is completed”. (Lenin, Imperialism)

Lenin's definition is of the imperialist stage of capitalism. Lenin is talking about the world system, he is not trying to define one country by ticking five boxes. This is what he describes as a world system, the division of the world between the biggest capitalist powers. I will argue that China fulfils all of these different conditions to one degree or another, and is now part of the world imperialist system.

Lenin also talks in Imperialism about the inevitability of the rise and fall of imperialist powers:

“This is because the only conceivable basis under capitalism for the division of spheres of influence, interests, colonies, etc., is a calculation of the strength of those participating, their general economic, financial, military strength, etc. And the strength of these participants in the division does not change to an equal degree, for the even development of different undertakings, trusts, branches of industry, or countries is impossible under capitalism. Half a century ago Germany was a miserable, insignificant country, if her capitalist strength is compared with that of the Britain of that time; Japan compared with Russia in the same way. Is it ‘conceivable’ that in ten or twenty years’ time the relative strength of the imperialist powers will have remained unchanged? It is out of the question.”

First of all, as I said, China is dominated by big monopolies. Chinese companies are huge, and these huge companies dominate a very large percentage of the total of the Chinese economy and these monopolies have a projection in the world economy.

Just to give you an indication, a total of 135 Chinese companies figure in the Forbes 500 list of the biggest companies in the world in 2023, the fifth consecutive year that Chinese companies were at the top of the list in terms of number. The United States has 136, Japan has 41 in the list. So China has more or less the same number of huge companies as the US in this 500 list.

Finance also dominates China's economy and there's a fusion between finance capital and industrial capital. This feature is very marked in China. Although there are different ways of measuring size: the amount of deposits, value of capitalisation, number of workers, but by one measure, at least, China possesses the four largest banks in the world: the Industrial Commercial Bank of China, the China Construction Bank, the Bank of China and the Agricultural Bank of China. These are the four largest banks in the world, and they play a big role in China's economy. They also play a big role in the world economy.

While it is true that these banks are all state-owned, as a result of the way in which capitalism emerged in China, the country also has a large ‘shadow banking’ sector, which according to an official report in 2019 accounted for 86 percent of GDP, US$12 trillion.

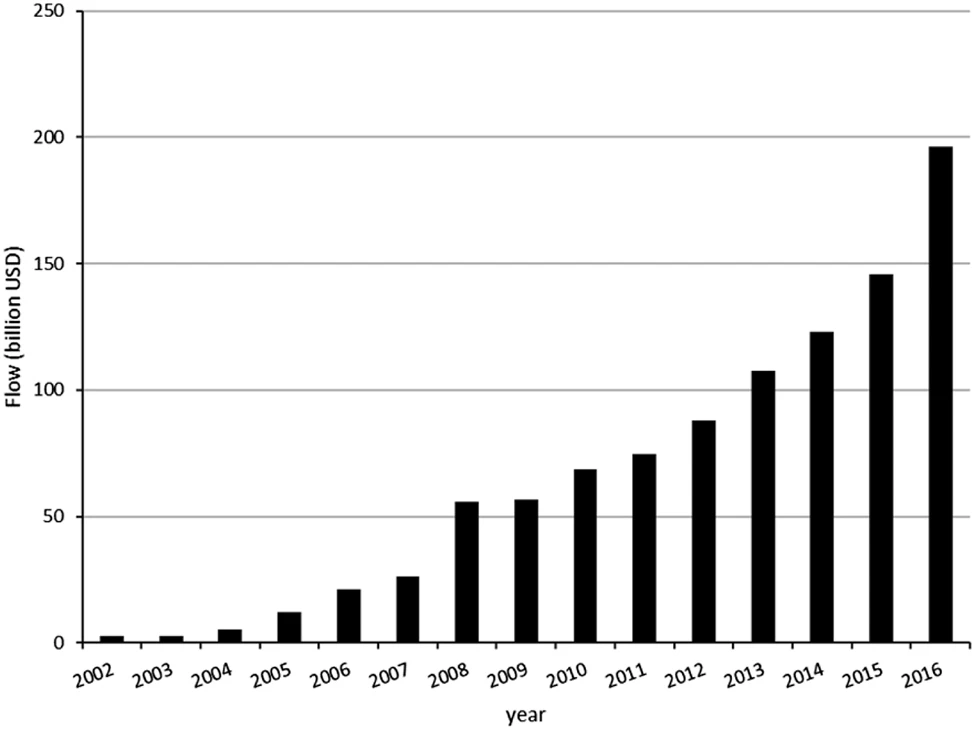

China has also exported capital for some time now. If you look at the graph for the Chinese exports of capitals, it goes up and up from approximately 2005, particularly after 2010. And is now very, very high. Of course, there are certain things that have been happening in the last two or three years, the COVID-19 pandemic, the lockdown and the disruption of world trade supply chains, and so on. This has disrupted some of these patterns. But up until that point, the curve was upwards. Just to give you an indication, China's outgoing foreign direct investment began to rise after 2000. The annual flow of China's outward foreign direct investment jumped from US$2.7 billion in 2002 to US$200 billion in 2016. In the space of about 15 years, it multiplied by 100.

Flow of Chinese outward foreign direct investment, 2002–16 / Image: NDRC

Flow of Chinese outward foreign direct investment, 2002–16 / Image: NDRC

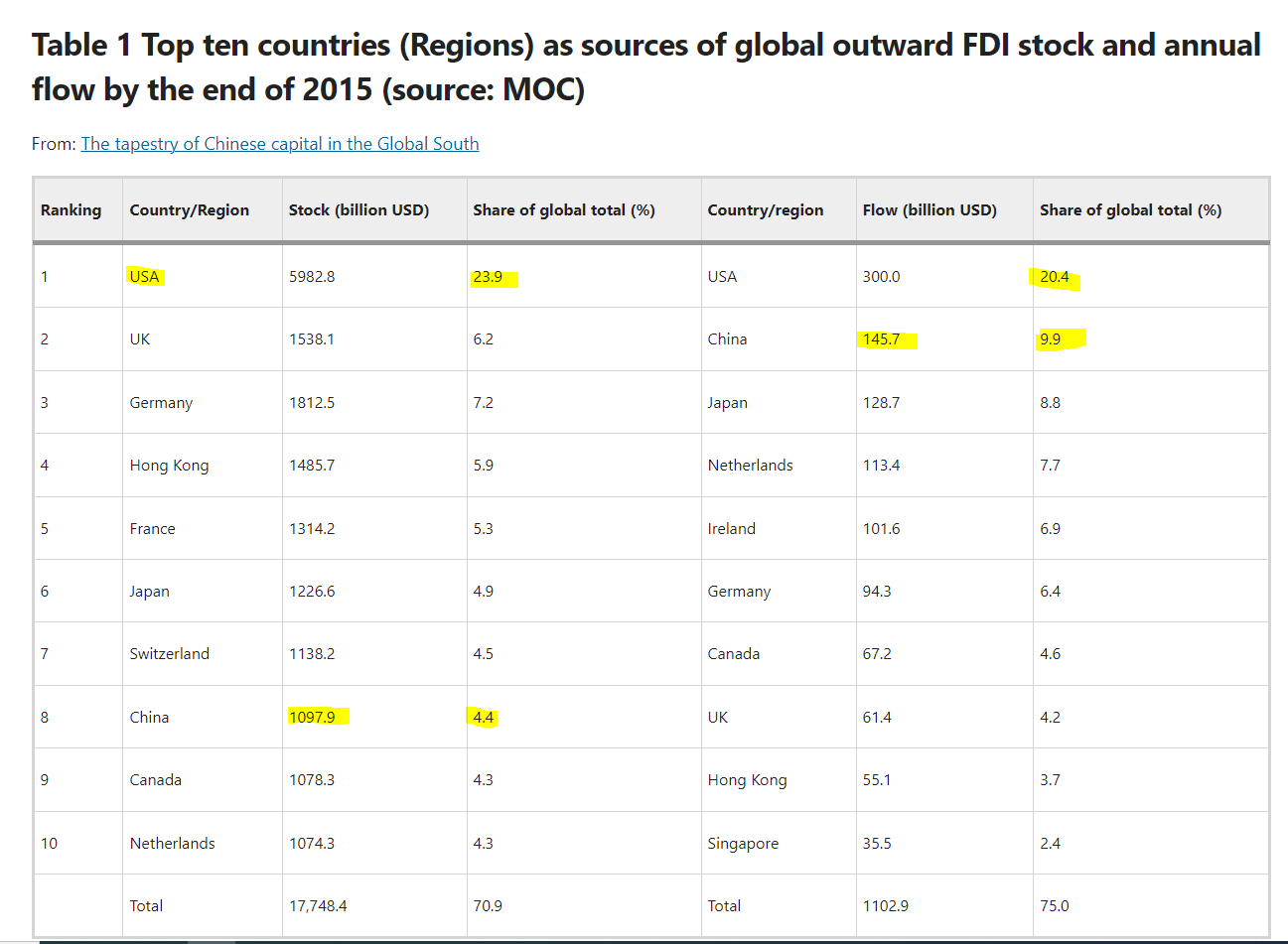

I'll give you some other figures for the top 10 countries and regions in the world as sources of outward foreign direct investment, stock, and annual flow for 2015. The source is the Chinese Ministry of Commerce.

In terms of stock, i.e. accumulated foreign direct investment, the USA was at the top with 23 percent share of the global foreign direct investment stock. China was number eight, at only 4.4 percent. But Hong Kong, which is counted separately, was fourth at 5.9 percent in terms of total stock, i.e. accumulated foreign direct investment over a period of time. But in terms of flow, i.e. the money that goes out every year as foreign direct investment, the US in 2015 was still number one with 20 percent of share of the total global foreign direct investment flow, but China was number two, with 10 percent, half that of the United States. Hong Kong was number nine with 3.7 percent. If you add Hong Kong to China that makes about 13.6 percent, which is not that far from the outward foreign direct investment for the United States at that point in 2015. Many Chinese private companies are also registered in Singapore from which they in turn invest elsewhere, and therefore at least a portion of Singaporean investments should be seen as Chinese.

Of course, foreign direct investment is a very misleading category. Some of this money is then stashed in tax havens in the Cayman Islands, in the Seychelles, or in other tax havens like this. But quite a lot of this does go into foreign direct investment, mergers and acquisitions. We have seen China very strongly promoting investment of Chinese companies in buying and investing in other countries and in all sorts of things, which I will go into in a minute.

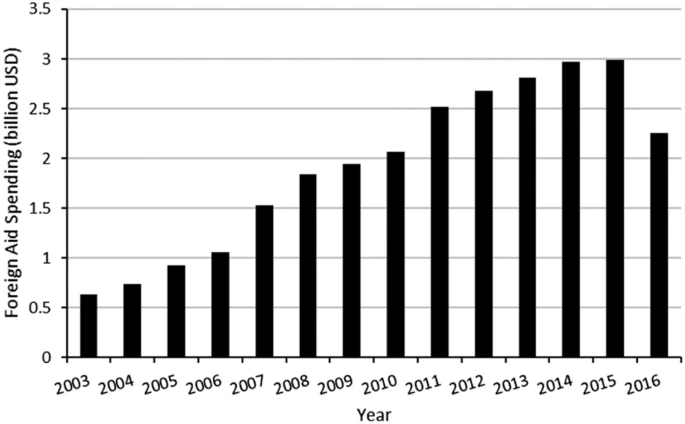

China's foreign aid expenditure (this is also another form of imperialism, because we know foreign aid is not really aid, it is about getting political clout and getting countries dependent on your foreign aid, etc.) was a very small amount, but it's growing very fast. Chinese foreign aid expenditure grew from US$600 million in 2003 to US$2.3 billion in 2016. Now, US$2.3 billion puts China in the range of medium sized capitalist countries like say Belgium or Australia in terms of spending in ‘foreign aid’.

China’s spending on foreign aid, 2003–16 / Image: CARI

China’s spending on foreign aid, 2003–16 / Image: CARI

Finally, there's the question of the division of the world between the main imperialist powers and China is now quite clearly part of this. You have probably heard of the Road and Belt Initiative, also known as the New Silk Road. What is its meaning? China is attempting to spend a lot of money on securing shipping and trading lanes for its export products, trading routes, and also to secure sources of energy and raw materials for its hungry industrial development. It is also securing fields of investment and chaining a whole number of countries to its area of influence, through the export of capital, through investment, and so on.

And this has quite clearly led China into an open conflict with the United States. We can see that there are now many different aspects or elements of a trade war between China and the United States, which started at the time of the Trump presidency, but which has continued with the Biden administration. It is not a partisan policy, it is a capitalist, ruling-class policy of the United States. And you have seen incidents of this. For instance, the United States lobbied Britain very strongly not to allow Huawei to build 5G infrastructure. And this is because right now, Huawei, which many of you might think of as a maker of cheap mobile phones, is now one of the main players in 5G infrastructure in the world.

This is a very sharp development of technology. And China is at the top in this technology. There are other cases. The United States is lobbying Brazil very hard not to allow Huawei in. Canada arrested some Huawei executives. And all of this has nothing to do with industrial espionage or worrying about Whitehall mobile phones being listened in on by China. There might be an element of that, but essentially it comes down to competition between different capitalist companies.

Incidentally, this also proves another point. There were some people 20 years ago, who were arguing that imperialism didn't exist anymore, that what we had was “Empire”: one world conglomerate of companies that dominate everything without any relation to nation states (for instance, see: Hardt and Negri, Empire, Harvard University Press, 2000). No, imperialism does exist and is divided between different warring and competing imperialist powers. China defends the interests of Huawei, the United States defends the interests of Boeing, and the European Union defends the interests of Airbus in the world market by any means necessary that are at their disposal.

This, as I said, brings China into conflict with the United States. This is very clear, and this conflict is manifested in many different fields. Right now China is not using military power to secure its imperialist interests… or, at least, so far. And that makes some people say, "Oh, but the Chinese investment in Africa is friendly investment, it is not like imperialists, that organised military coups and sent gunboats, etc." Yes, it is true that the same means have not yet been used. But that doesn't mean Chinese investments have a different character to imperialist investments from other countries.

China is not using military power to exercise its imperialist interests abroad because it is not yet able to. China is still much weaker than the United States in military terms, although it is catching up in a whole number of areas. The United States has built its military power all around the world for a very long period of time. So China is principally using finance, diplomacy, and so on.

However, it has to be said that China has already built a military base in Djibouti. Djibouti is obviously a very important choke point for international trade at the mouth of the Red Sea. And several of the harbours that are being built, or have been built through the Road and Belt Initiative, potentially have a dual military-civilian use.

Part of this is US propaganda, but part of it is also potentially true, and the classic pattern of Chinese direct foreign investment in different countries runs as follows: a Chinese state owned bank lends money to country A; country A then uses this money to carry out some big infrastructure projects; a dam, hydro-electric power station, railway, the improvement of the capacity of a harbour to offer service to big ship ships, and so on. This infrastructure project is usually then carried out by Chinese infrastructure companies, China's civil construction, railway construction companies. Chinese companies then operate this infrastructure project, for instance, a Chinese railway company operates the railway, a big Chinese hardware company takes over, etc. And then, in exchange for this investment, which takes the form of a loan, this country becomes indebted to China. In exchange for this, China obtains the right to exploit minerals or other natural resources; obtains preferential trade in soybeans, or meat; or gains some other such concession. And these infrastructure projects, interestingly, link the raw materials that this country possesses to harbours from which they're going to be shipped to China.

These projects are then put as collateral for this debt, and when this country, as often happens, defaults on its debt, the Chinese get full control of the infrastructure they have been built. And this all builds debt and political leverage, creating a relationship which cannot be described in any other way than that of an imperialist country with a dominated country.

And this is happening everywhere. It is happening in the whole of Africa and Latin America, in many Asian countries. And I can give you many, many examples.

For instance, amongst other things, China has developed a string of investments in harbours around the world that they regard as crucial for shipping lanes. If you look at the map, you will be surprised. I certainly was! (See: China has acquired a global network of strategically vital ports, Washington Post, Nov 6, 2023)

China now controls or has investments in (in some cases a small investment, e.g. 10 percent, 30 percent, and in other cases a dominant position) all the main shipping lanes around the world: the Malacca Straits, Malaysia, Singapore, Indonesia, and obviously this big harbour in Sri Lanka. Then there's the Gwadar harbour that they have built in Pakistan, which also means that there's going to be a connecting land route through Central Asia. Incidentally, all of this also bypasses India, which is a traditional enemy of China in world relations. And then from Gwadar you go to Djibouti, the harbour that I mentioned before, which was built and is owned by a Chinese company. Then, on the other side of the mouth of the Red Sea, there's the port of Aden, which the Chinese have also invested in.

On the Mediterranean side, you have port sites in Egypt, at the mouth of the Suez Canal, the Haifa harbour in Israel. Then you go to the port of Piraeus in Greece, which is wholly owned by a Chinese company, Cosco. From there you can go on to some harbours in the north of Italy, the harbour in Valencia in Spain, the port in Algiers, ports in Morocco.

From there you can go all the way up to the port of Bilbao, a number of ports in France, a port in Belgium, Rotterdam, which is one of the largest ports in the world. And now it's been agreed that there will be Chinese investment in the port of Hamburg and other trading routes.

Before the war in Ukraine, China invested in the ports of Odessa and Mykolaiv, which are now, obviously, not very useful. But they have investments like this.

And then also on the Pacific side, China has investments in the Port of Los Angeles and the Port of Seattle, two of the biggest ports on the Pacific coast. And China is now building a port in a new harbour in Chancay in Peru, which is going to cut the time that the trading takes between China and South America by five to ten days.

So that just gives you an idea of what they're trying to do. They want to secure shipping and trading routes, which is not “evil, plotting and scheming”. It is just the behaviour of an imperialist country that wants to secure its interests in the world.

I'll just give you one example. In Zambia, a landlocked country in southern Africa, which is very rich in copper, the Chinese have invested and have the rights to extract copper. Zambia is now heavily indebted to China. The Chinese have now built and renovated a railway line that connects the mines in Zambia to the Dar es Salaam harbour in Tanzania, in order to extract copper.

A key region in the world economy right now in terms of mineral resources is Central Africa, particularly Congo, where a lot of cobalt is mined, but also all the other important minerals for development of new technologies. And guess what: the Chinese are building a series of railways that will connect the Indian Ocean coast with Congo, one that connects Rwanda, Malawi, Burundi, with Uganda, another one that connects Kenya with Djibouti, and so on. The idea of this is to provide a proper, fast way of extracting these raw materials from these important areas of the world. Nairobi to Mombasa, Addis Ababa to Djibouti, and there are many other examples like this.

Ecuador is heavily indebted with China, and so too are Sri Lanka, Tanzania, etc.

The same thing is happening in the whole of South America. About two years ago, China became the main trading partner for the whole of South America. And this is quite damaging from the point of view of the interests of US imperialism. About 200 years ago, this year, the Monroe Doctrine was enunciated. And the Monroe Doctrine says "America for the Americans", which basically means the Americas is the backyard of US imperialism, and no other imperialist powers will be allowed to have any say in the whole of America. Well, now you have China, which is the main trading partner with the whole of South America, particularly countries like Chile, Argentina, Ecuador, Peru, Brazil, and Bolivia.

China wants to secure shipping and trading routes / Image: public domain

China wants to secure shipping and trading routes / Image: public domain

With all these countries, what is the character of this trade? China purchases raw materials, copper, beef, pork, oil, gas, lithium, soybeans, (contributing, by the way, to the deforestation of whole regions of South America) and sells manufactured goods, machinery, transport equipment, chemicals, which are the main items that China exports.

At the same time, China invests money in Latin America through foreign direct investment. China has bought the electricity grid in many of the Brazilian States and Chinese privately owned electric vehicle companies, BYD and Great Wall Motors, have now bought two big car plants in Brazil, one that was formerly owned by Ford, and one that was formerly owned by Mercedes. Two western imperialist companies have left Brazil, and they’ve been taken over now by two Chinese companies that are going to build electric vehicles.

Incidentally, the world's largest manufacturer of electric vehicles is now BYD, although these figures are a bit of a trick, because BYD produces both pure electric vehicles and hybrid electric vehicles, while Tesla, which is a main competitor, produces only electric vehicles. So it's not the same, but it's up there. [Since this talk was delivered, BYD has surpassed Tesla as the world’s largest manufacturer of pure electric vehicles.]

I would argue that all of these facts and figures demonstrate the fact that China is an imperialist country, and this has certain consequences and implications. Some people say that the role that China plays in the world economy is a positive one, progressive even, because this means that we can now hope for a multipolar world, one that is no longer dominated by US imperialism. This, they say, is a positive development for the peoples of the world, particularly in the oppressed countries, who they claim now have free room to develop.

But this is completely wrong. There is no advantage for the working class, either in the advanced capitalist countries or in the dominated capitalist countries, in a change from the world being dominated, or mostly dominated, by one imperialist country, to now having different imperialist powers fighting for control over different countries. This doesn't improve the situation of the working people, the poor peasants and the poor people in the oppressed nations of the world. It just means there is more conflict. There are more regional wars between the two of them.

If anyone attended the talk yesterday about the situation in Africa and French imperialism, you can see that, clearly, it is not an improvement. For the workers of the world, their interest is to fight against all imperialist powers, not to fight so that different imperialist powers balance one another. It is true, however, that because China now plays a bigger role in the world economy, certain countries are trying to balance one power against the other, and to change allegiances slightly.

For instance, we have seen a whole number of countries that were in the past very close allies of the United States, or that were basically puppets completely dominated by the United States, like Turkey, Saudi Arabia, or even Brazil, for instance, now trying to play a more independent role in world politics. It doesn't mean that Saudi Arabia has cut off its links with the United States. No, they are trying to play China off against the United States, to gain a bit of an advantage for themselves. This is not beneficial for Saudi Arabian workers, who are still under the yoke of a semi-feudal, reactionary monarchy. Many of them are foreign immigrant workers in conditions where they have no rights, very low wages and are highly exploited. But in the conflict in Ukraine, it's clear that Saudi Arabia has been leaning towards helping Russia, to keep oil prices up, and is trading with Russia.

There are other factors in the US-Saudi relationship. The United States is almost self-sufficient in terms of oil, which wasn't the case in the past. But clearly, if you were watching the world this year, you would realise that there was a peace agreement between Saudi Arabia and Iran, that was brokered by China. And this means that the United States are no longer playing as dominant a role in the Middle East as they were able to play in the past. The same was the case with the war in Syria.

Now, the other thing we need to say is that this process has certain limits. We're not saying that China is growing in influence in the world, is growing in its role as an imperialist power, and at some point will overtake the United States and become the main imperialist power in the world. We're not saying that. That is because this process has certain limits, which I think the Chinese economy has more or less now reached.

China's economy has been for many years investing in gross capital formation, i.e. building machinery, factories, industries, and is now facing a classic capitalist crisis of overproduction. It produces too much steel, too many cars, and too much of everything, which they cannot sell anywhere. It is a classic crisis of capitalism.

It is also a crisis of the tendency of the rate of profit to fall. The same amount of investment in machinery and technology in China no longer produces the same amount of GDP growth, as it did in the past. China is still growing, but certainly not at the same rate as in the past.

The Chinese and US economies are extremely interconnected / Image: 李 季霖, Flickr

The Chinese and US economies are extremely interconnected / Image: 李 季霖, Flickr

There are also other factors. The Chinese and US economies are extremely interconnected. Therefore there are US companies that have an interest in avoiding a trade war. For instance, Foxconn has built a huge industrial enterprise in China that builds most of the Apple phones that people use in the West. They are obviously not interested in a trade war, and there are many other western companies invested in China that are playing a restraining role.

From time to time, you see western capitalist leaders going to China for a trade conference, trying to reestablish normal diplomatic relations.

Finally, the United States as a world imperialist power, is declining in its role, but this decline is still a relative decline. Sometimes people say, "Oh, China has already overtaken the United States as the biggest economy, or will overtake the United States", but China has a much bigger population than the United States. This means that the productivity of labour in the United States is still much higher than in China overall, China being a very uneven and unequal country. It is not the same in the coastal areas, where most of the capitalist development has taken place, as it is in the areas in the interior, which still lag behind.

In terms of military power, the United States is still far ahead. Just to give you an example, China has only two aircraft carriers and the United States has 11, over 5 times more. In many other areas, this is the case.

So, I think that while the situation obviously leads to more tensions, more potential for regional wars and local wars, it does not mean that China will overtake the United States anytime soon. China is facing up to its own limits.

The last point I want to make is this: what is the position of communists in relation to this situation? The position of communists is the following: the main enemy of the working class is at home. In the UK, or in the United States, our main enemy is not China. Our enemy is the ruling class in this country. And our allies are the workers of the world, including the workers in China.

This is the interesting point: economic development and the development of capitalism in China has created a powerful working class, a working class that has no recent traditions of struggle. There have been many strikes, uprisings and explosions of struggle, but the Chinese working class doesn't have a long-established tradition of reformist parties and trade unions. It is a fresh working class. Many of them are first generation migrants from the countryside into the cities. They're working in conditions of high exploitation.

And as I'm describing this, some of you might be thinking that there are similar parallels between this and what happened in Russia in 1917. Or what happened in Spain in 1970. Or what happened in Brazil in 1980. A first generation working class under conditions of dictatorship, where there are no avenues for legal trade union, or political development, in conditions of high exploitation, where the conditions have changed very quickly over a short period of time. This led to what? A revolutionary explosion.

And this is what's being prepared in China. Our task is to link up with the Chinese working class and to fight together to overthrow imperialism and capitalism all over the world. Our task is not to celebrate there being more imperialist countries, and the world being more multipolar, but rather to strengthen our resolve to fight against capitalism and imperialism, which are the main source of wars and exploitation, a system that has already outlived any useful role that it might have played in the past.